Member States

Definition of Member States

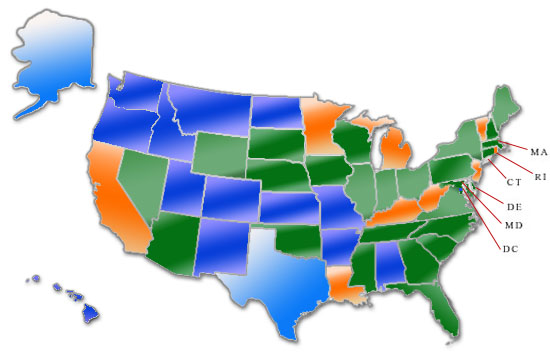

Compact members are states (represented by the heads of the tax agencies administering corporate income and sales and use taxes) that have enacted the Multistate Tax Compact into their state law.* These states govern the Commission and participate in a wide range of projects and programs.Sovereignty members are states that support the purposes of the Multistate Tax Compact through regular participation in, and financial support for, the general activities of the Commission. These states join in shaping and supporting the Commission’s efforts to preserve state taxing authority and improve state tax policy and administration.

Associate members are states that participate in Commission meetings and otherwise consult and cooperate with the Commission and its other member states or, as project members, participate in Commission programs or projects.

*Alabama, Ala. Code § 40-27-1; Alaska, Alaska Stat. Ann. § 43.19.010; Arkansas, Ark. Stat. Ann. § 84 4101; Colorado, Colo. Rev. Stat. § 24-60-1301; District of Columbia, D.C. Code § 47-441; Hawaii, Haw. Rev. Stat. § 255-1; Idaho, Idaho Code § 63-3701; Kansas, Kan Stat. Ann. § 79-4301; Missouri, Mo. Rev. Stat. § 32.200; Montana, Mont. Code § 15-1-601; New Mexico, NM Stat § 7-5-1; North Dakota, N.D. Cent. Code § 57-59-01; Oregon, Ore. Rev. Stat. § 305.655; Texas, Tex. Tax Code § 141.001; Utah, Utah Code Ann. § 59-22-1; Washington, Wash. Rev. Code § 82.56.010.